Table of Contents

- Introduction: Why Choose investorbit.de?

- What Is investorbit.de?

- How Does investorbit.de Work?

- Step-by-Step Guide to Getting Started

- Account Types on investorbit.de

- Verification Process Explained

- How to Make Your First Investment

- Investment Options Available on investorbit.de

- Tips for Beginners Using investorbit.de

- Is investorbit.de Safe and Legit?

- Pros and Cons of investorbit.de

- Common Mistakes to Avoid as a First-Time Investor

- FAQs about investorbit.de

- Final Thoughts: Should You Start Investing on investorbit.de?

1. Introduction: Why Choose investorbit.de?

If you’re new to the world of investing and looking for a platform that is easy to understand, beginner-friendly, and packed with features — investorbit.de might be just what you need. This guide is designed to help you understand how the platform works and how you can make your first investment with confidence.

2. What Is investorbit.de?

investorbit.de is an online investment platform that allows users to invest in various financial instruments like stocks, cryptocurrencies, ETFs, and more. It is designed for both beginners and experienced investors, offering a user-friendly dashboard, real-time analytics, and low entry barriers.

3. How Does investorbit.de Work?

The platform works by allowing users to create an account, verify their identity, deposit funds, and then choose from a wide range of investment options. You can monitor your portfolio in real-time and make changes as per market trends or personal goals.

4. Step-by-Step Guide to Getting Started

Step 1: Visit investorbit.de

Open your browser and go to the official website:

Step 2: Create Your Account

Click on the “Sign Up” or “Register” button and enter your basic details like:

- Full name

- Email address

- Phone number

- Password

Step 3: Verify Your Identity

You will need to upload documents like:

- Passport or ID card

- Proof of address (utility bill or bank statement)

Step 4: Deposit Funds

Use any of the supported payment methods such as:

- Bank Transfer

- Credit/Debit Card

- PayPal

- Cryptocurrency (in some cases)

5. Account Types on investorbit.de

investorbit.de offers various types of accounts to meet different user needs:

- Basic Account – Good for casual investors with limited access to tools.

- Premium Account – Offers in-depth analytics and priority support.

- Professional Account – Suitable for high-volume traders and seasoned investors.

6. Verification Process Explained

To keep your investments secure, investorbit.de follows a strict KYC (Know Your Customer) process.

Why is this important?

- Prevents identity theft

- Keeps your funds safe

- Ensures platform compliance with international laws

Verification usually takes 24–48 hours.

7. How to Make Your First Investment

Once your account is verified and funded, you can start investing by:

- Navigating to the “Invest” section

- Selecting the asset class (e.g., Stocks, Crypto, ETFs)

- Reviewing performance history

- Entering the amount you wish to invest

- Clicking “Confirm Investment”

Your portfolio will update in real-time.

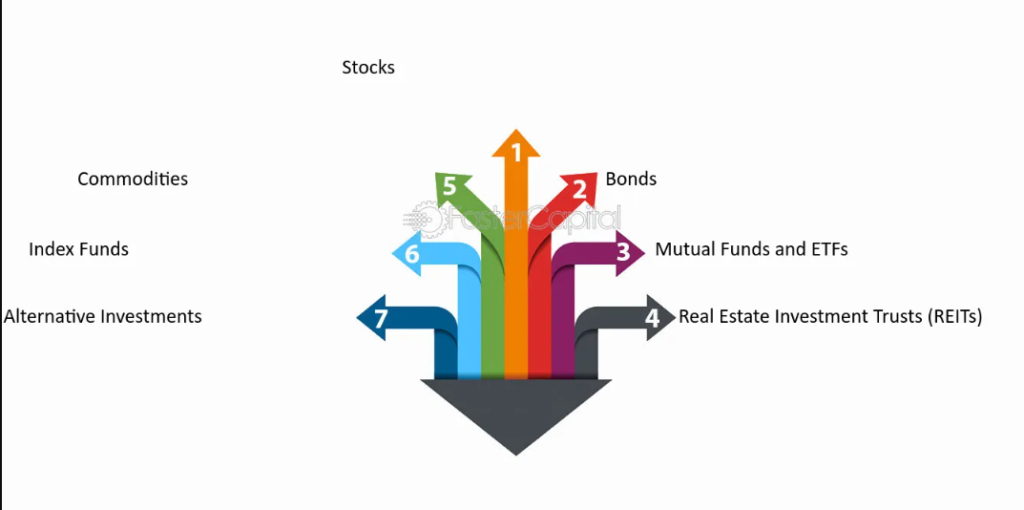

8. Investment Options Available on investorbit.de

You’re not limited to one type of investment. investorbit.de offers:

- Stocks: Apple, Amazon, Tesla, and more

- ETFs: Diversified funds for risk-managed investing

- Cryptocurrencies: Bitcoin, Ethereum, Solana

- Commodities: Gold, silver, oil

- Forex: Currency pairs like EUR/USD, GBP/JPY

9. Tips for Beginners Using investorbit.de

- Start small: Invest small amounts to understand market behavior.

- Use demo tools: Some accounts come with demo investments.

- Set goals: Know whether you want short-term gains or long-term returns.

- Avoid hype: Make informed decisions, not emotional ones.

10. Is investorbit.de Safe and Legit?

Yes, investorbit.de is considered safe and reliable by many users. It offers:

- SSL Encryption for data protection

- Two-Factor Authentication (2FA)

- Regulatory Compliance under EU laws

- Secure Wallets for crypto storage

However, no platform is risk-free, so always do your own research.

11. Pros and Cons of investorbit.de

✅ Pros:

- Easy to use for beginners

- Multiple investment options

- Transparent fee structure

- Advanced analytics for premium users

❌ Cons:

- Limited customer support on weekends

- Some assets not available in all countries

- Verification can take up to 48 hours

12. Common Mistakes to Avoid as a First-Time Investor

- Skipping research before investing

- Following trends blindly without understanding them

- Investing all your funds in one asset

- Ignoring fees and hidden charges

- Overtrading, especially in volatile markets like crypto

13. FAQs about investorbit.de

Q1: Is there a mobile app for investorbit.de?

Yes, there is a mobile app available for both Android and iOS.

Q2: What is the minimum deposit required?

Usually, the minimum deposit is around €50, but it may vary by country or payment method.

Q3: Can I withdraw funds anytime?

Yes, withdrawals can be requested anytime but may take 1–3 business days.

Q4: Is customer support available in multiple languages?

Yes, support is available in English, German, and a few other European languages.

Q5: Are there any hidden fees?

No, investorbit.de is transparent about its fee structure. All fees are mentioned upfront before you confirm a transaction.

14. Final Thoughts: Should You Start Investing on investorbit.de?

If you’re looking for a reliable, easy-to-use, and versatile platform for your first investment, investorbit.de is a strong choice. It offers everything a beginner needs: guided setup, a variety of assets, strong security, and educational resources.

The key is to start small, educate yourself, and stay consistent. investorbit.de gives you all the tools to grow your wealth — the rest depends on your strategy and patience.

Ready to take the first step in your investment journey?

👉 Visit investorbit.de and begin building your financial future today!